Options Analysis Tools - Options Premium

An option's premium consists of intrinsic value and extrinsic value. Intrinsic value is reflective of the actual value of the strike price. Extrinsic value is made up of time until expiration, etc.

An option's premium consists of intrinsic value and extrinsic value. Intrinsic value is reflective of the actual value of the strike price versus the current market price. Extrinsic value is made up of time until expiration, implied volatility, dividends and interest rate risks.

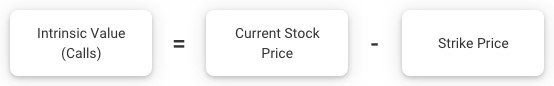

Intrinsic Value (Calls)

A call option is in-the-money when the underlying security's price is higher than the strike price.

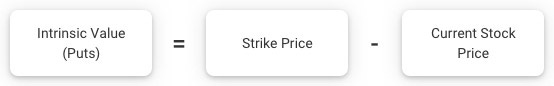

Intrinsic Value (Puts)

A put option is in-the-money if the underlying security's price is less than the strike price.

Only in-the-money options have intrinsic value. It represents the difference between the current price of the underlying security and the option's exercise price, or strike price. Essentially, intrinsic value exists if the strike price is below the current market price in regard to calls and above for puts.

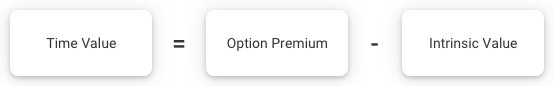

Time Value

Time value is any premium in excess of intrinsic value before expiration. Time value is often explained as the amount an investor is willing to pay for an option above its intrinsic value. This amount reflects hope that the option's value increases before expiration due to a favorable change in the underlying security's price. The longer the amount of time available for market conditions to work to an investor's benefit, the greater the time value. Time value is also referred to as extrinsic value as other factors influence an option's premium outside of intrinsic value.

Changes in the underlying security price can increase or decrease the value of an option. These price changes have opposite effects on calls and puts. For instance, as the value of the underlying security rises, a call will generally increase. However, the value of a put will generally decrease in price. A decrease in the underlying security's value generally has the opposite effect.

The strike price determines whether an option has intrinsic value. An option's premium (intrinsic value plus time value) generally increases as the option becomes further in-the-money Select to open or close help pop-up. It decreases as the option becomes more deeply out-of-the-money Select to open or close help pop-up.

Time until expiration, as discussed above, affects the time value component of an option's premium. Generally, as expiration approaches, the levels of an option's time value decrease or erode for both puts and calls. This effect is most noticeable with at-the-money Select to open or close help pop-up options.

The effect of implied volatility is subjective and difficult to quantify. It can significantly affect the time value portion of an option's premium. Volatility is a measure of risk (uncertainty), or variability of price of an option's underlying security. Higher volatility estimates indicate greater expected fluctuations (in either direction) in underlying price levels. This expectation generally results in higher option premiums for puts and calls alike. It is most noticeable with at-the-money options.

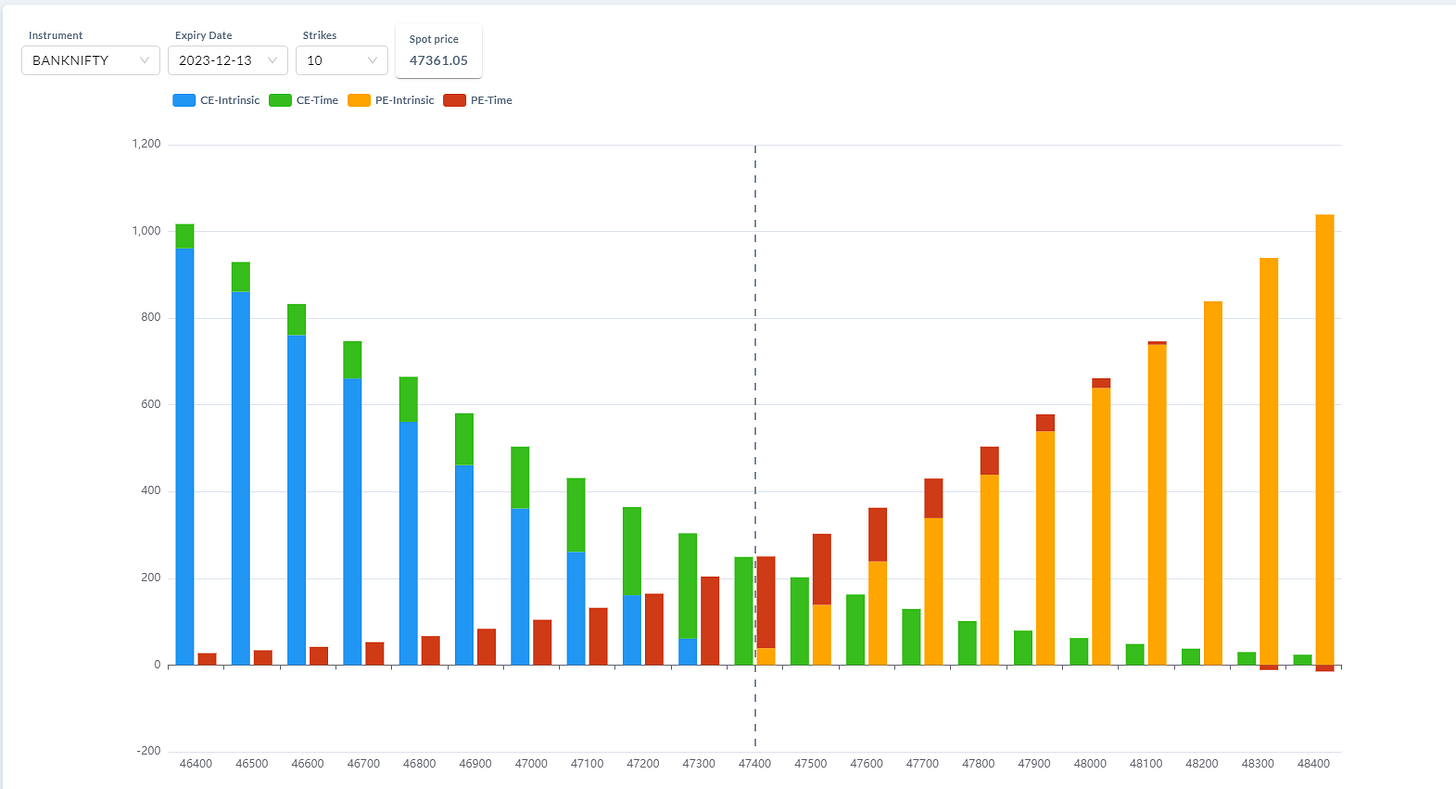

How can we use this information to find the right strike for Option Buying or Selling?

If you are buying an option, then you would want a strike price where there is comparatively less time value, and in case you are selling an option, then you would want a strike price where the options premium has more time value component (theta).

In real time, this value is very dynamic and it’s better to use this chart to find a better strike price before you initiate a trade.

hello the options are priced based on futures price but you are showing options extrinsic value based on spot value. For weekly options if there is no futures price calculate option extrinsic value based on synthetic futures based on put call pairity