FNOTrader - Index Watch

If you are an Index Trader, then you will love this feature. With the Introduction of every day expiry on the indices, the expiry traders are busy trading the expiries all 5 days of the week.

If you are an Index Trader, then you will love this feature. With the Introduction of every day expiry on the indices, the expiry traders are busy trading the expiries all 5 days of the week.

As of this writing, We have the following expiries

Monday - MidcapNifty, Bankex

Tuesday - FinNifty

Wednesday - BankNifty

Thursday - Nifty

Friday - Sensex

However, there is no single place to track all the indices, this made us develop a single screen to track important aspects of an Index such as Index Chart, Top 10 Heavyweight table, Option Chain, OI Trend, Dynamic ATM Straddle.

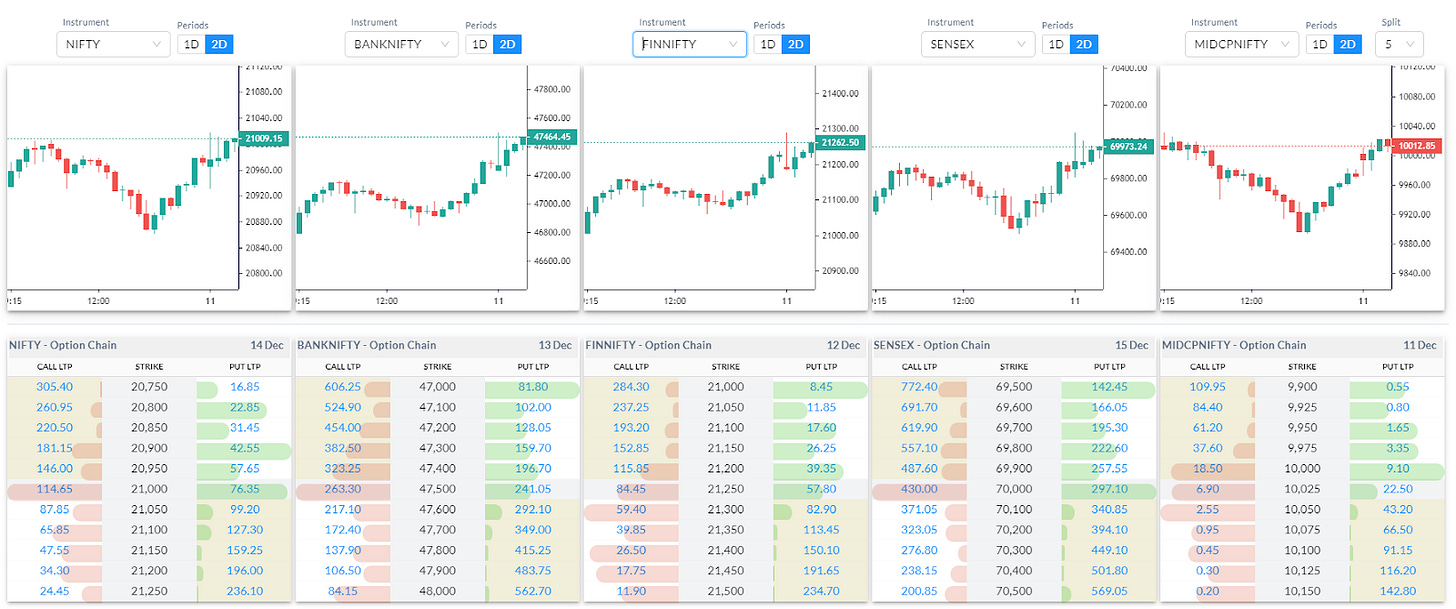

This is how the page looks if viewed on a laptop or any big screen.

Index Selection Dropdown, Right top corner - Option to select how many expiries you want to track. You can track up to 5 expiries in a single screen.

Index Watch Page

Spot Price Chart: The top chart shows the Index Spot chart for 1 or 2 days data on 15 min chart intervals.

Option Chain: Displays option chain of the current expiry is shown for ATM + or - 5 strikes. Shows the Last Trade Price (LTP) and OI in coloured horizontal bars.

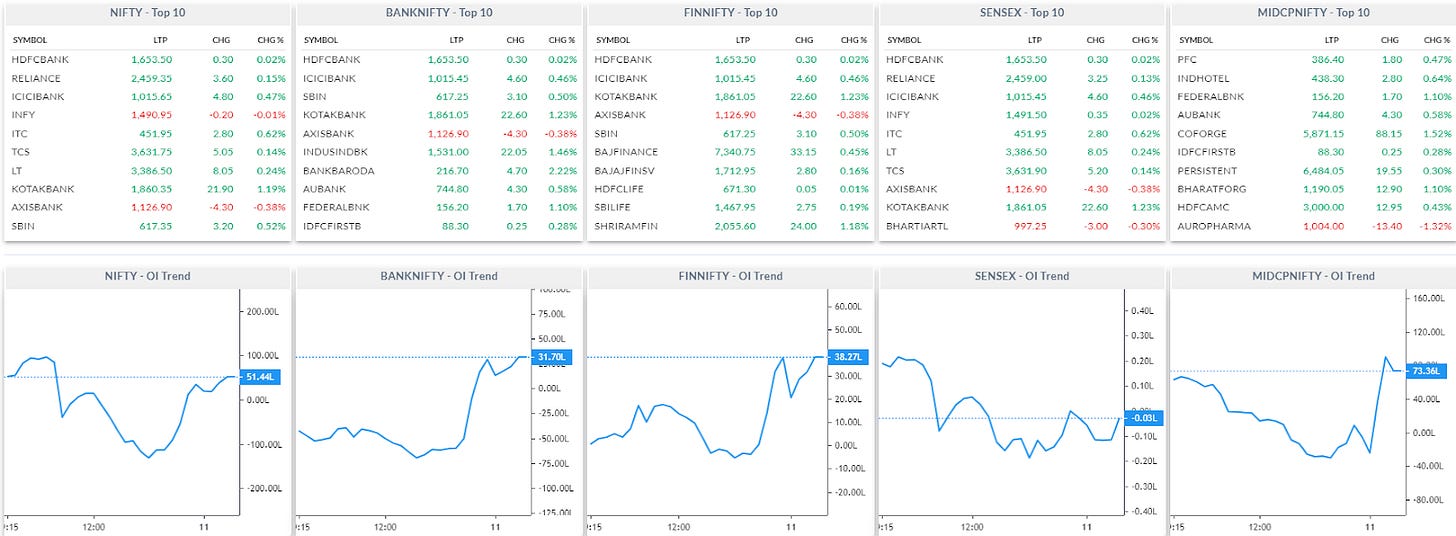

Top 10: Displays the Top 10 index heavyweights sorted based on the weightage in table format. Shows, LTP, price change and percent change.

Option OI Trend: Displays the Option Open Interest (OI) Trend. OI Trend is calculated by considering the Total Open Interest Change of the PE side - Total Open Interest Change of the CE side, plotted as a line graph. In order to increase the sensitivity, we consider ATM + or - 5 strikes.

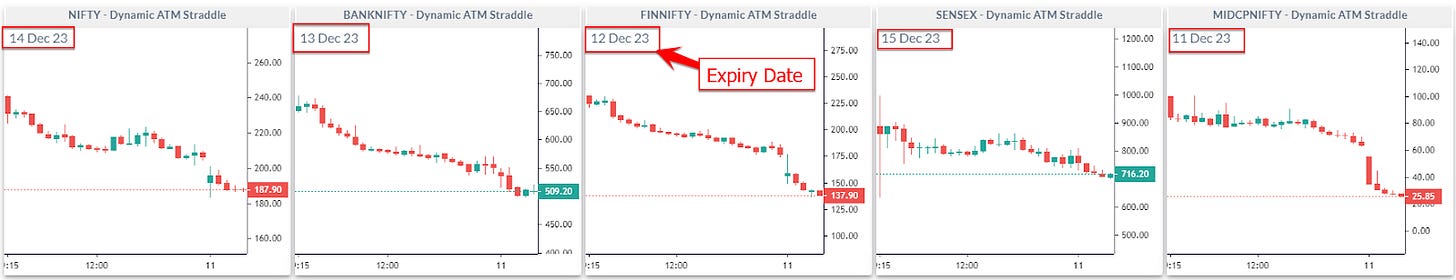

Dynamic ATM Straddle: Displays the options price behaviour (indicative of Theta Decay) by plotting the real time ATM straddle price. A downward sloping chart indicates a decay in option prices (theta decay - time value).

Each of the options has its own feature page which lets you have more control over how you want to display.

In the next post, we will cover the options analysis tools.